Setting up the Business Central on BeWo

Initiating the Integration

To begin integrating Microsoft Dynamics 365 Business Central with your BeWo account:

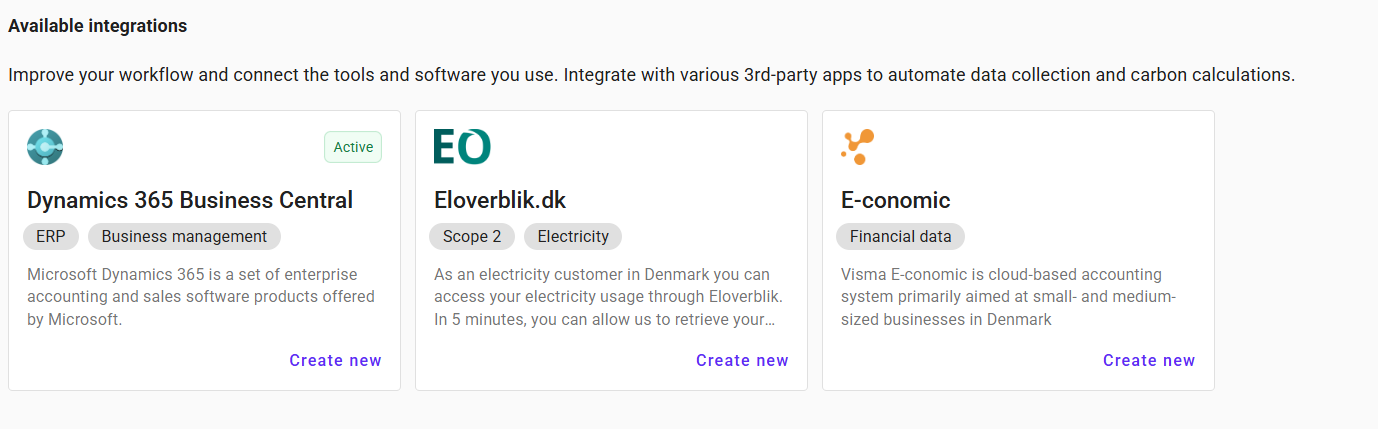

- Navigate to Integrations: Select "Integrations" from the BeWo menu.

- Create new Integration: Click on "Create new" under "Dynamics 365 Business Central" to open dialog.

Configuration process

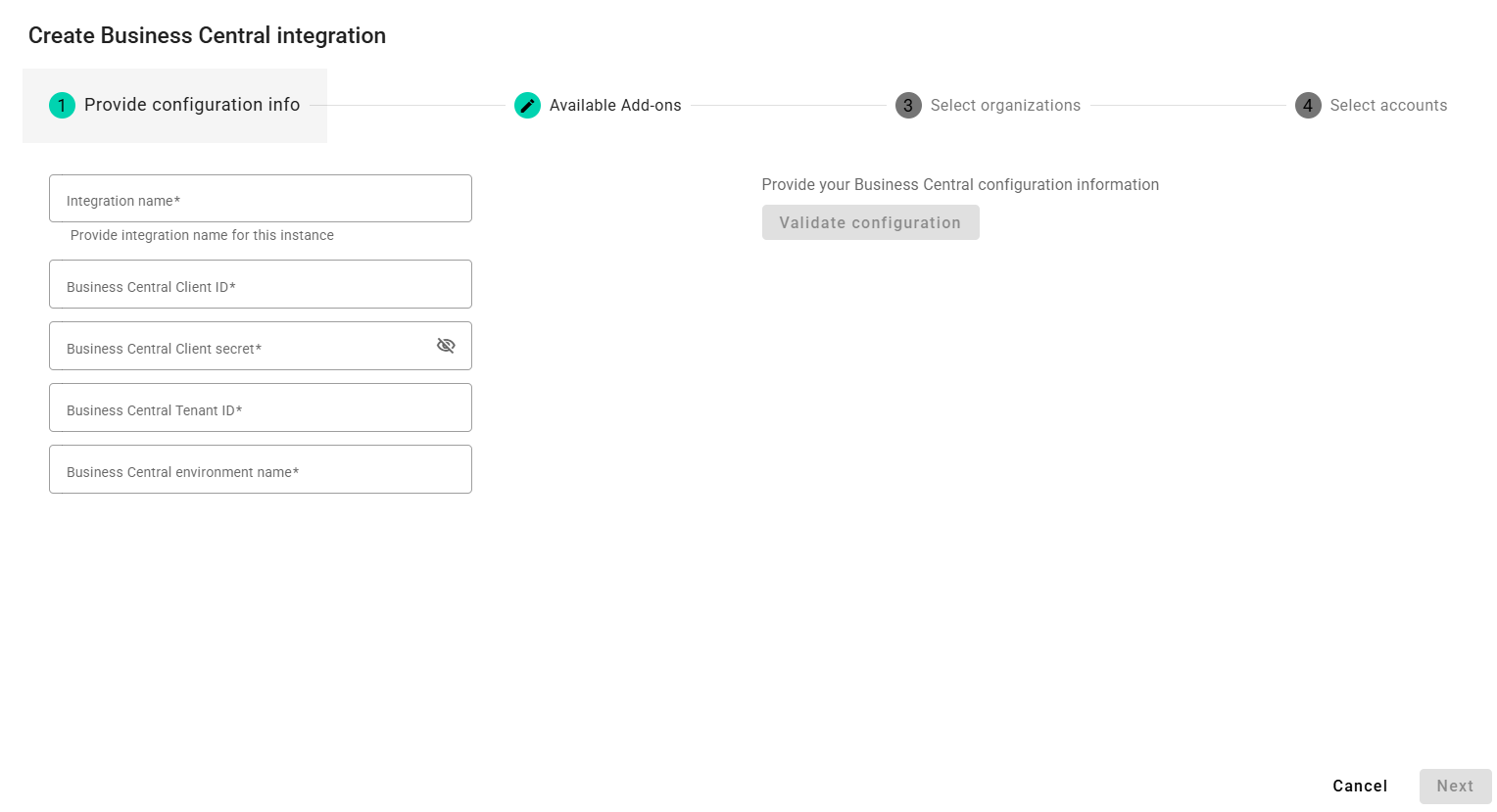

Step 1: Provide Business Central configuration information

- Contact your partner to provide necessary credentials to connect with Microsoft Dynamics 365 Business Central.

- Click “Next” to proceed to next step.

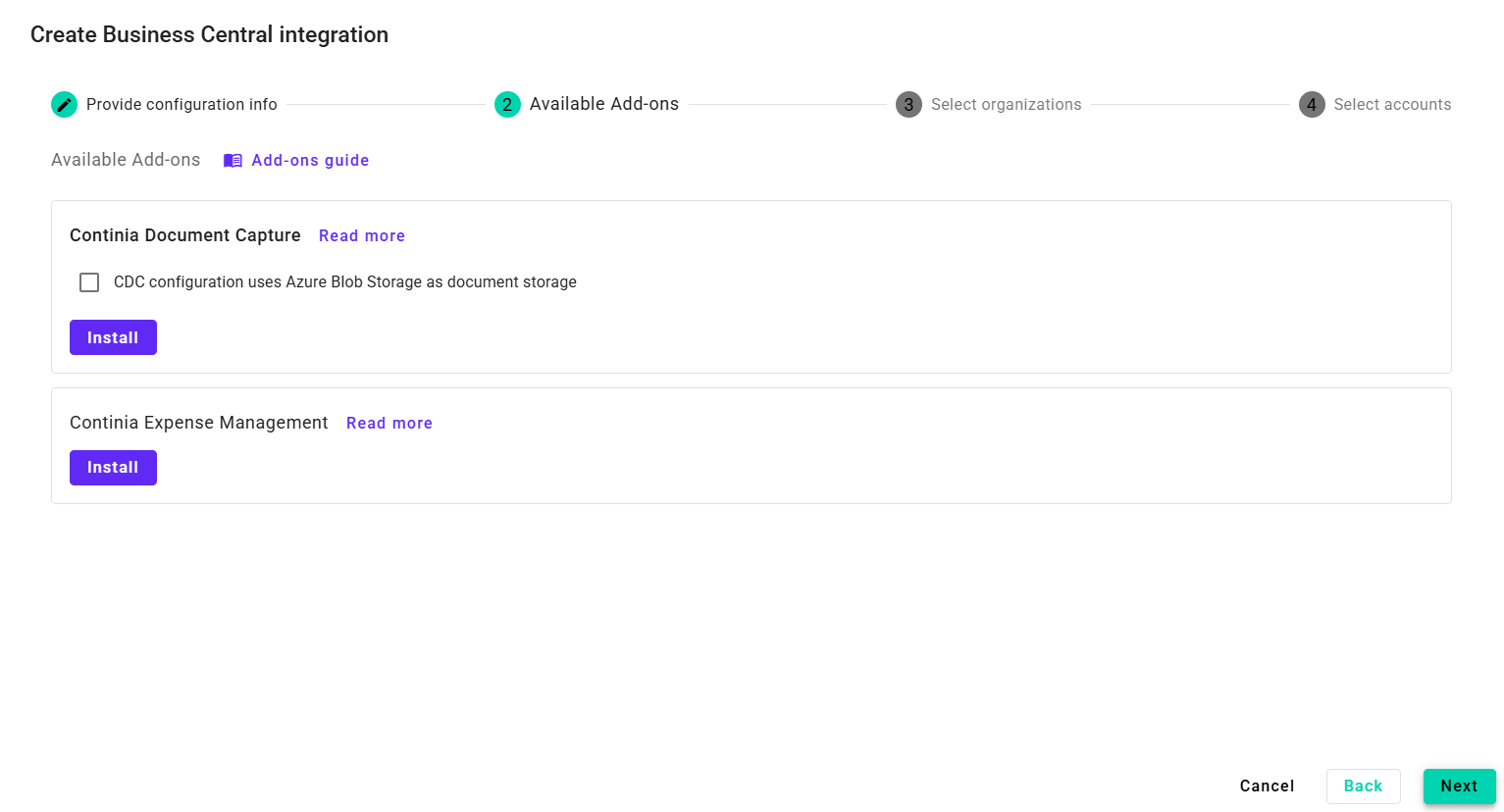

Step 2: Configure Add-ons

- Certain add-ons must be installed if your system uses them. Without these add-ons, the necessary information for a complete reporting experience may not be retrieved.

- Click “Next” to proceed to next step.

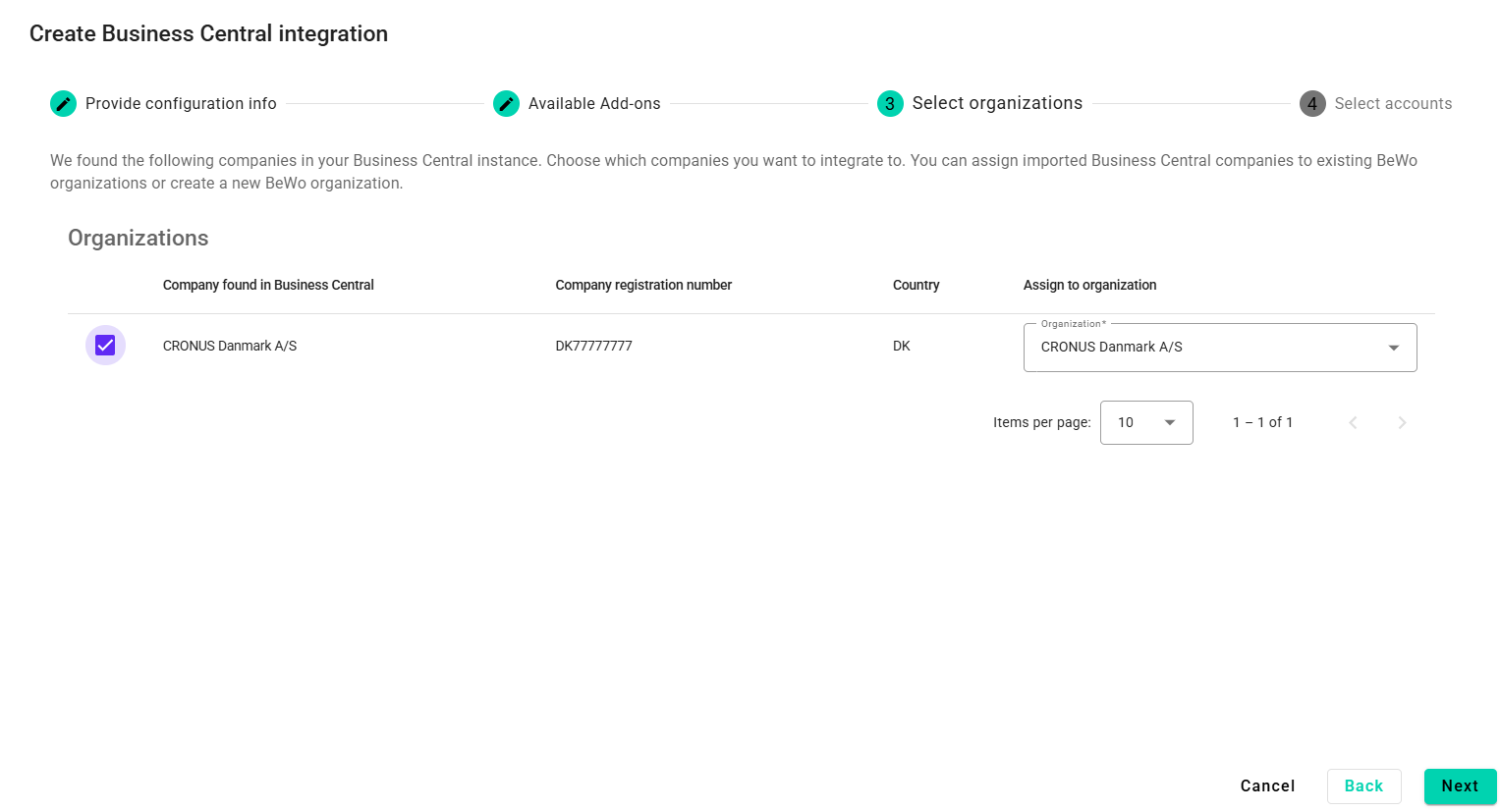

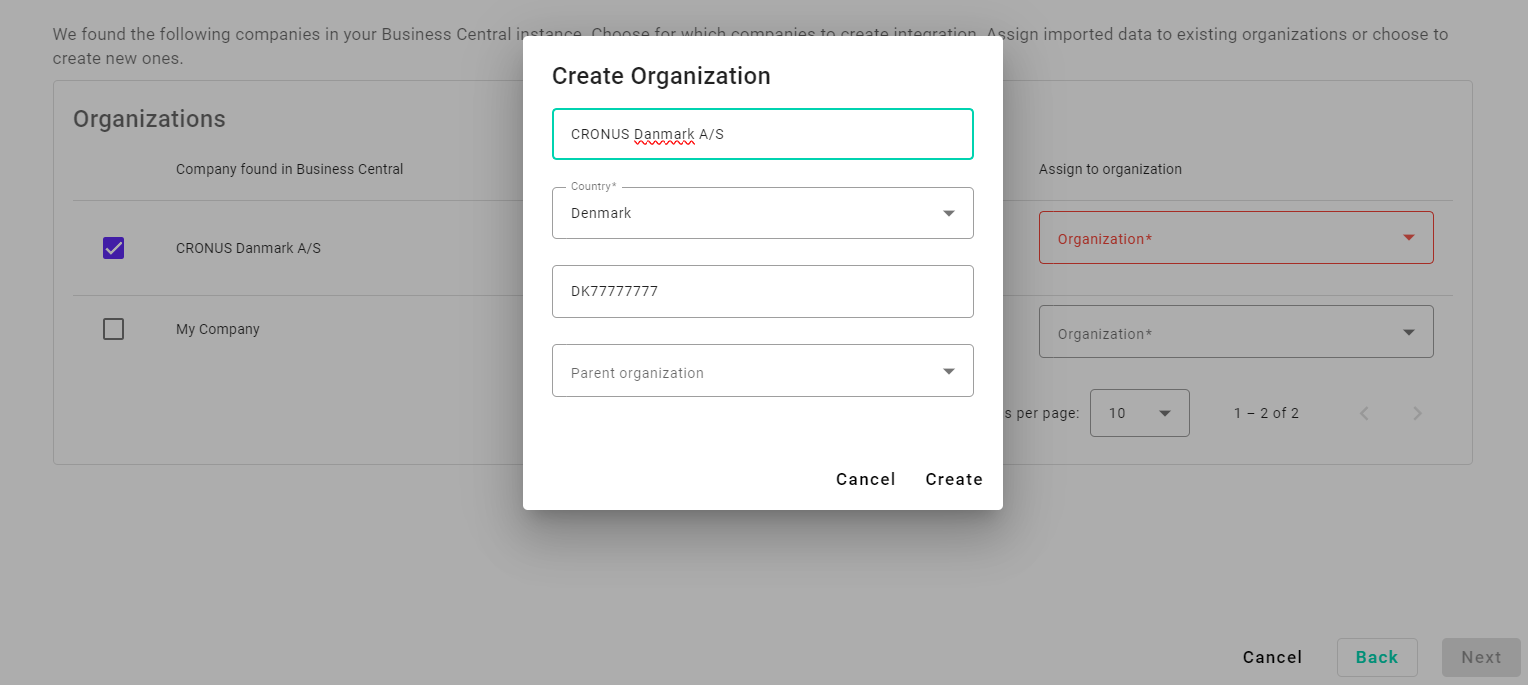

Step 3: Select companies from Business Central

- Check boxes for the companies which should be included in the integration.

- Assign seleted companies to either exisiting orgnizations or create a new one.

- Click “Next” to proceed to next step.

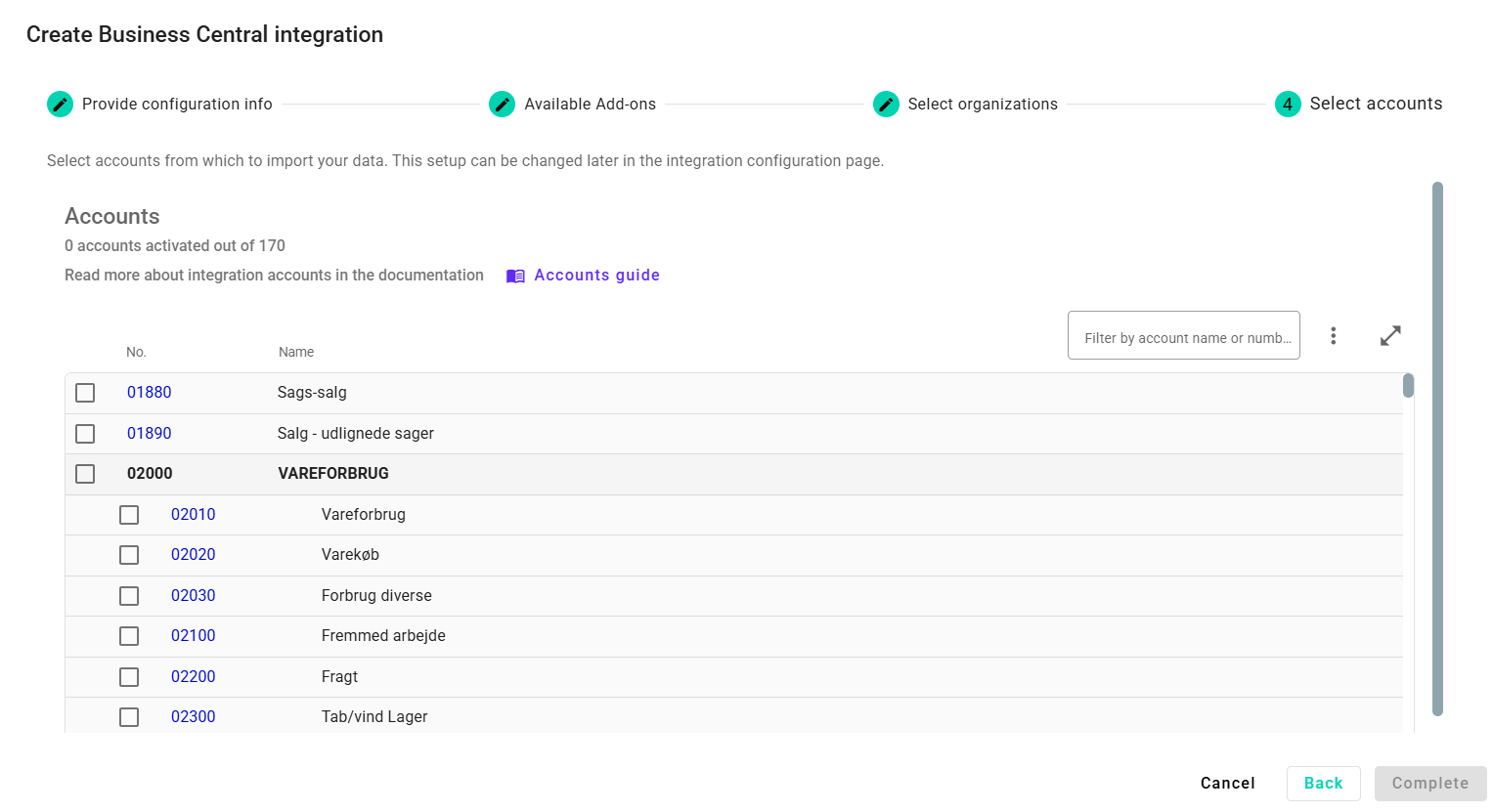

Step 4: Select Business Central accounts

- In this step you have to select the relevant accounts that you want to include in your calculations.

- Click “Complete” to finallize your integration setup.

Step 4a: Accounts to Include

info

You can use the following guidance as a rule of thumb, but every system will look differently based on the setup.

| Account Category | Description | |

|---|---|---|

| Direct Expenses | Both with and without VAT | ✅ |

| Goods for Personal Use | Goods paid for by the company but used by the employees outside work - Personalegoder (Danish) | ✅ |

| Multimedia Expenses | Multimedia tools and platforms | ✅ |

| Mileage Allowance | Kilometergodtgørelse (Danish) or Taxfree milage | ✅ |

| Employee Expenses | Restaurant visits, gifts, travel, etc. | ✅ |

| Advertising | Marketing and promotional costs | ✅ |

| Freight Costs | Freight costs in connection with distribution of product or just e-commerce shopping | ✅ |

| Fuel | Fuel consumption expenses | ✅ |

| Car Operations | Operating company vehicles | ✅ |

| Insurance | Insurance costs | ✅ |

| Utilities | Electricity, water, heating | ✅ |

| Maintenance and Cleaning | Upkeep of company premises | ✅ |

| Office Supplies | Daily office materials and supplies | ✅ |

| Newspapers and Subscriptions | Newspapers and any subscriptions | ✅ |

| Software | Software licenses and subscriptions | ✅ |

| Furniture | Office or company furniture | ✅ |

| Telecommunications | Phones, IT hardware, internet services | ✅ |

| Professional Services | Auditor, lawyer, consultant fees | ✅ |

| Books and Publications | Books and publications | ✅ |

| Memberships | Membership fees from interest organizations and other | ✅ |

| Website Hosting | Hosting the company website | ✅ |

| Increases during the year | Increases in captial goods, e.g. assets, land and buildings, equipment and machines | ✅ |

Step 4b: Accounts to Exclude

| Account Category | |

|---|---|

| Payroll | ❌ |

| Holiday Pay | ❌ |

| Pension Contributions | ❌ |

| Maternity Leave Payments | ❌ |

| Fees and Commissions | ❌ |

| Taxes | ❌ |

| Interest Payments | ❌ |

| Loans and Financing | ❌ |

| Bank Accounts | ❌ |

| Charges and Tolls | ❌ |

| VAT | ❌ |

| Receivables | ❌ |

| Intercompany | ❌ |